After Losing Home In Wildfire, Vacaville Couple Learns Insurance Company Dropped Them

VACAVILLE (CBS13) — No home, no job, and no way to rebuild, a Vacaville couple is left scrambling to figure out how to move forward after their home was destroyed by the LNU Lightning Complex Fire.

"Within a minute or two, there was a pounding on the door from the authorities. They said, "Gotta get out, gotta get out," said Curt Hatton.

"Within a minute or two, there was a pounding on the door from the authorities. They said, "Gotta get out, gotta get out," said Curt Hatton.

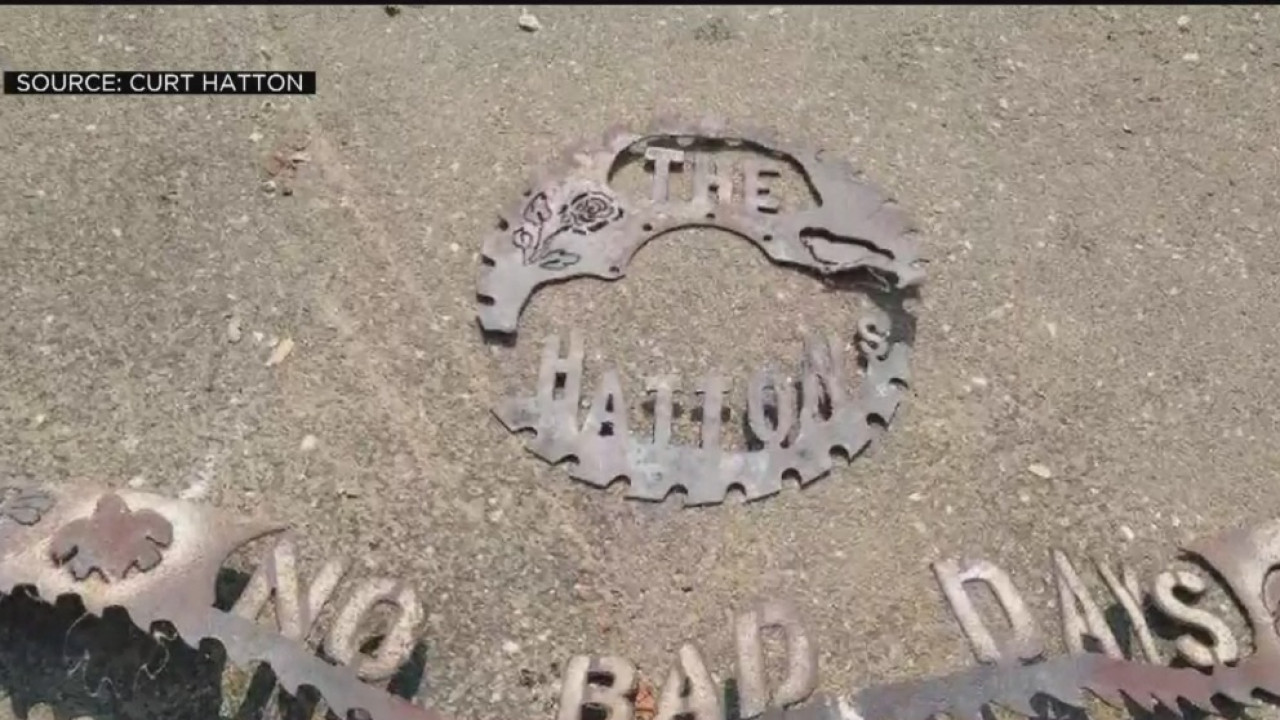

Hatton and his wife Aree took one last look at their home and the sign above their front door which read, "no bad days." They fled the fire, which in minutes, took over Gibson Canyon.

"Two days later, just rolling embers," said Curt Hatton.

The place they called home for 20 years was now just ash and debris.

"I don't know how to explain it, it's deep in my heart," said Aree Hatton.

READ: Protest Held After Vacaville Prisons Aren' Evacuated During LNU Complex Fires

The only bright spot is that some of Aree's art is still standing, but the good news for this Vacaville couple ends there.

"I diligently called the insurance company to file a claim, and I was shocked to learn they didn't have a home policy on me," said Curt Hatton.

The Hattons are among thousands of homeowners losing their insurance coverage over fire risk. Some insurers are pulling out of California even in non-fire zones.

Curt says his insurance company just supplied him with a letter of non-renewal that says it was mailed to him in April, but he says he never got it.

"I received no such letter," he said.

The letter says his policy expired just one month before and gave them reasons for why they were being dropped.

ALSO: 'Still Kind Of Numb': Vacaville Home With Classic Cars, Antique Collections Burned To Ground

"They had, as a lot of insurance companies do in California, classified you in a high fire, high-risk area," Curt Hatton said.

So what is required from insurance companies when they decide to drop a policyholder? The State Department of Insurance says insurance companies need to have valid renewal guidelines in place. They need to provide 75 days of advanced notice and give a reason for the non-renewal.

If the policyholder has a mortgage, then the insurance company has to send the notice to the lender. Also, leaders with the State Department say homeowners like the Hattons need more support.

"Insurance companies need to play a bigger role to help people protect their homes and bring down that risk," said Hatton.

For the Hattons, they're not sure what's next, they say rebuilding will likely be too expensive. They plan to work with the State Insurance Department to see if they were dropped legally. They'll be looking to see if that insurance policy was actually sent to them 75 days before they were dropped.